Record surpluses again? What's really going on?

The content in this article may now be out of date. Please try searching for a more recent version.

The new government clearly has Housing Association surpluses in its sights as an untapped source of cash to help deliver its promised spending cuts.

Many of our customers will see their income reduced as a result of cuts to benefits and tax credits.

Many of our customers will see their income reduced as a result of cuts to benefits and tax credits.

At a time when local authority services are being severely cut back these customers will look to us to offer them the advice and support they will need. Helping our customers to unlock their own potential in challenging times is a key part of our social purpose and we have been increasing our spending on such services. But the rent cuts and right to buy measures announced recently will make this harder at the very time that customers need it most. I recently summarised the impact of these measures.

So what is the reality of Housing Association funding?

Last year I published a simple view of how the funding model has changed over the decades and concluded that:

- The past is paying for the present

- The present will not fund the future

- The future looks worse than the present

All that still holds true and recent policy announcements make both the present and the future a whole lot more challenging for us and for our customers.

To try and reduce the potential impact of the worsening future environment we aim to operate as efficiently as we possibly can; we think about how we spend our money to add the most value for our customers; and we aim to limit the amount of money we have to borrow to build new homes.

So how do we use our money?

The surplus we make is not paid out to shareholders or spent on higher salaries or locked away in a bank vault. It is used as working capital to reduce the amount we need to borrow to build new homes and reinvest in our existing homes. Last year (2014-15) we spent £59.4m on building new homes with 510 completed and 428 started during the year and only received £3.1m in grant. All the rest came from existing loans and cash surpluses, without the need to borrow any more money.

That reduces our interest costs so creates a virtuous circle of cash available for reinvestment. If we didn’t have this cash available we would quickly get into a downward spiral of increased interest costs and ever lower profits that would seriously restrict our ability to build new homes.

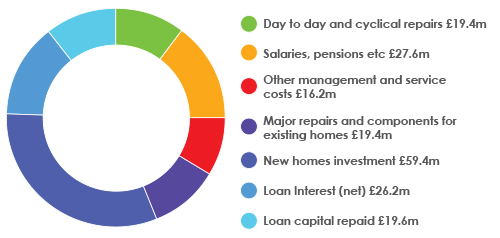

Here’s a broad overview showing how we used our cash last year:

Cash In – 2014/15 - £177.5m

Cash Out – 2014/15 - £187.8m

Overall in 2014/15 we received £177.5m of cash and spent £187.8m, so reducing our cash holdings by £10.3m.

So despite the £43.8m surplus shown in our accounts, in real cash terms we spent more last year than we received. This is a similar figure to the previous year 2013/14 when we spent £10.6m more than we received in cash, but made a £39m surplus. Housing Association surpluses don’t show the money we spend on new homes and some major repairs because accounting rules mean this expenditure doesn’t appear in our income and expenditure accounts, but is reflected in our cash-flow statements and balance sheets.

Let’s not forget too that housing associations are increasingly offering far more than just a set of keys to a home. Many, like Bromford, are delivering services that create huge social value such as money advice, access to training, the creation of apprenticeships and services to help people find employment. Those are exactly the services our customers will need more of to help them depend less on a state that will be providing much less but we are only able to provide them because we are financially sound – now and for the future. We’ve been here for over 50 years and we see it as our long-term stewardship responsibility to make sure we are still around in another 50 years to help people overcome challenging circumstances and unlock their own potential.

Read Philippa's thoughts on what the 2015 Summer budget means for #UKHousing.

Read Philippa's recent blog on 'Right to Buy'.

Follow Philippa on twitter: @PhilippaJones2